The “Belt and Road” covers many regions such as Asia-Pacific, Europe and Asia, the Middle East and Africa. It is a strategy for China to actively develop economic cooperation with countries along the route. However, although there are many people who know the “Belt and Road”, but very few people who spy on the potential business opportunities in the national markets along the Belt and Road.

In fact, the 65 countries covered by the Belt and Road, the total population accounts for 63% , and the economic aggregate accounts for 30% of the world. Most of them are emerging economies and developing countries, which are in the period of economic development and have great market development potential. Next, CITITRANS will analyze the e-commerce market opportunities behind the countries along the Belt and Road, as a reference for China's cross-border export sellers to go out to the Middle East.

I. Basic conditions for the development of e-commerce in the Middle East

1. Consumers

The Middle East has a population of about 490 million people, including a large youth group.

According to the YOUTHPOLICU.ORG data, more than 28% of the population aged between 15 and 29 in the Middle East represents at least 120 million young people in the region. The data also shows that the average age of the world is 28 years old, while the average age of Arab countries is 22 years old, which is one of the youngest regions in the world. Younger groups are more receptive to emerging shopping methods such as Internet shopping.

2. Topography and climate

In terms of topographical distribution, the Middle East is dominated by desert terrain and resources are scarce, so that most of the goods are imported.

In terms of climate types, the tropical desert climate in the Middle East has the widest distribution. The hot climate provides a good market environment for the development of the e-commerce market where people in the Middle East can freely shop without leaving their homes.

3. Higher per capita disposable income

The Middle East is rich in oil resources, so it has significant wealth and strong purchasing power. According to data released by KNOEMA, in 2017, Qatar, Israel, Kuwait, UAE, Saudi Arabia, Oman and other countries in the Middle East have domestic GDP per capita in the top 50 in the world, higher than the world ranking of China's per capita GDP.

4, network coverage

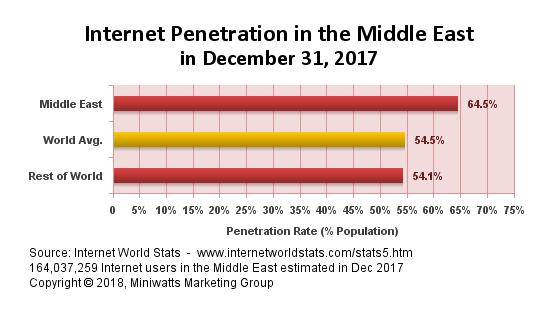

According to Internet World Stats data, there were about 160 million Internet users in the Middle East at the end of 2017.The Internet penetration rate exceeded 60%, which was also higher than the global average.

In particular, the UAE, Qatar, Saudi Arabia, Jordan, Lebanon, and Bahrain have Internet penetration rates of more than 90%, Separately 98.4%, 98.1%, 90.2%, 97.8%, 91.0%, and 98.0% of the population have smartphones. The high Internet penetration rate and Internet penetration in the Middle East provide excellent conditions for the development of the e-commerce market.

Ⅱ, The online shopping habits of consumers in the Middle East

1. Online shopping habits

According to a survey conducted by PricewaterhouseCoopers (PWC) 2017 Middle East Retail Industry, consumers in the Middle East have the following online shopping habits:

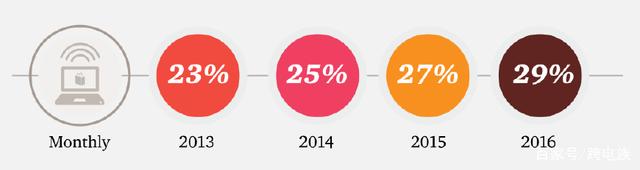

1) The number of consumers who choose to shop online is growing. The number of people who shop online in the Middle East from 2013 to 2016 is increasing year by year. In 2016, more than a quarter (29%) of Middle Eastern consumers shop online every month.

2) Consumers prefer to shop on the mobile online portal.

According to the survey, 56% of consumers said that mobile phones are about to become their main tool for online shopping, and 41% of consumers said they have used mobile devices to shop online. But in the process of using mobile devices, consumers said they prefer to use the mobile online portal, which is better than downloading a mobile app.

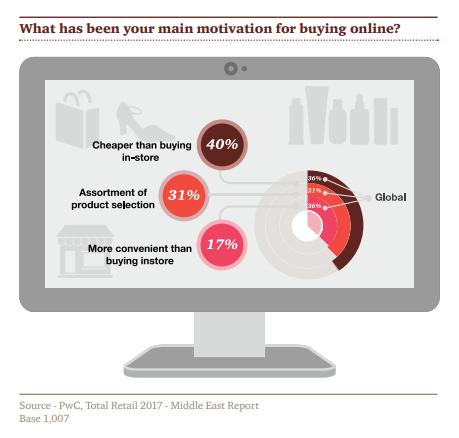

3) The reason why consumers in the Middle East prefer online shopping.

40% believe that online shopping prices are lower, 31% think that online shopping has more choices in product , and 17% think that online shopping is more convenient.In contrast, 36% of global respondents indicated that lower prices and convenience are their motivations.It shows that e-tailers have big opportunities to further develop and improve service convenience in the Middle East .

4) More consumers choose online shopping for multiple brands.

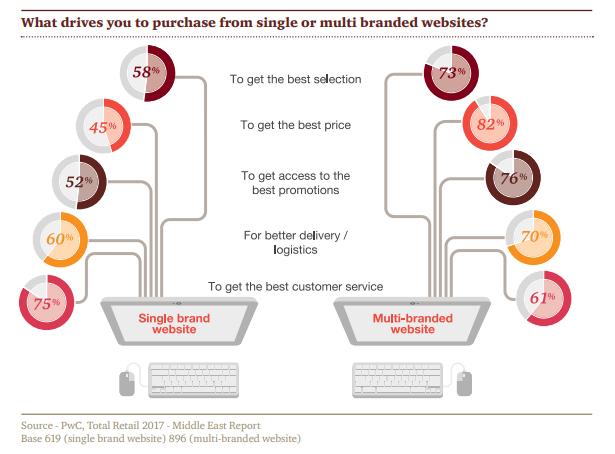

In terms of the choice of e-commerce platform types, 41% of consumers choose consumers who shop on a single brand online website, and 59% of consumers choose consumers who shop on multiple brands online. The main reason for choosing a single brand online website is to get the best customer service and the most convenient logistics method. The main reason for choosing multi-brand website shopping is to get the best promotion opportunities and more product choices.

2.Prohibited products and sensitive goods should be taken into account

Most of the Middle East is a Muslim country. On the one hand, most people believe in religion. On the other hand, because of differences in geographical characteristics and human factors, it is necessary to pay attention to the prohibition of merchandise and sensitive goods in cross-border trade. We should respect the religion and customs of the people in the area.

Religious sensitive items such as Piggy can not be sold; products with nude content containing text or images; only Chinese catalogues and instructions (at least English version required); perfume or beauty products require invoice to prove origin; baby products, toys , household appliances, groceries, home gardening, mobile phones and tablets, need to be in accordance with the EU XXX standard; must comply with local outlet specifications, the electronic product startup language must be English and contain Arabic options (electric appliances are also the case).

Ⅲ the development of e-commerce market in major countries in the Middle East

1. Saudi Arabia

According to Stastata data, Saudi Arabia’s e-commerce market revenue will reach $7.074 billion in 2018. It is expected to grow at a compound annual growth rate of 10.8% in 2018. The market transaction volume will reach 10.649 billion US dollars by 2022. User penetration rate is 64.4% in 2018 and is expected to reach 67.6% by 2022.

Statista data also shows that in Saudi Arabia's e-commerce market transactions in 2018. The largest categories are toys, hobbies and handicrafts (Toys, Hobby & DIY categories), the largest market segment for hobbies and stationery (Hobby & Stationery); followed by fashion Category (maximum market segment for apparel); electronics and media categories (maximum market segments for consumer electronics); furniture and electrical appliances (maximum market segment for household appliances); food and personal care categories (maximum market segment for individuals) Care). Among them, the biggest income of e-commerce for fashion, electronics and media, and household appliances comes from China.

In addition, in the Saudi Arabian e-commerce market, the top five e-commerce platforms for local online sales other than third parties are:

Iherb, yesstyle, tbdress, saksfifthavenue, fragrancex.

2. UAE

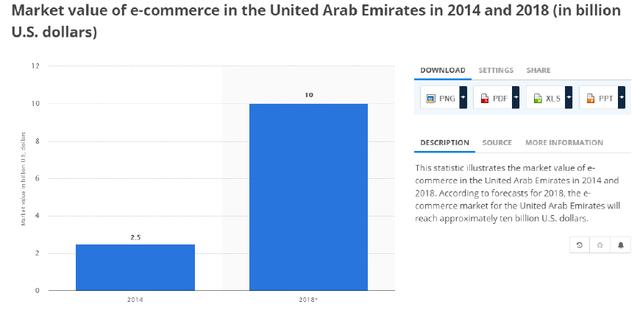

According to the data of Statista, the e-commerce market in the UAE will reach about 10 billion U.S. dollars in 2018, which has a large market development space.

According to GMI survey data, the most popular categories in the 2018 UAE e-commerce market are: software (41%), electronics (28%), apparel (17%) and fashion accessories (14%).

Secondly, according to GMI survey data, the most popular e-commerce platforms in the 2018 UAE e-commerce market are: souq, awok, wadi, namshi, landmarksops, desertcart, sharafdg.

In addition, in the future, there will be more e-commerce and convenient trade cooperation between China and the United Arab Emirates.

According to the United Arab Emirates 'United Daily News' reported on August 12, 2018, the UAE Ministry of Economic Affairs report shows that the total import volume of the UAE from the district increased from Dh33.8 billion to Dh302.2 billion, and the number of free zones built and under construction in the country. There are as many as 44, covering many fields such as industry, trade, technology, and services (logistics, finance, shipping, medical, education, media, information technology).

It is worth noting that China’s largest export market in the Arab countriesis the United Arab Emirates for many years. According to UAE’s Consul General in Shanghai, Rashid Kamz, China has become the largest trading partner of the UAE in 2017. The bilateral trade volumeIt was reached 40.98 billion US dollars.

Moreover, in July 2018, China and the UAE signed a memorandum in Abu Dhabi and decided to establish an e-commerce cooperation mechanism to support the cooperation between enterprises of the two countries in e-commerce projects, including promoting the trade of high-quality specialty products in their respective countries through e-commerce. We will open up new ways and new areas for China-UAE economic and trade cooperation and continuously improve the level of trade facilitation and cooperation between the two countries.

Ⅳ The main e-commerce platform in the Middle East

1, Souq: Middle East version of 'Amazon'

Founded in 2005, Souq was originally part of the Middle East leading portal-Maktoob. In 2009, Maktoob was acquired by Yahoo. Souq and the majority of the payment tool CashU were held in the hands of Maktoob’s founder-Samih. Souq then experienced several financings until March 2017 when Souq was acquired by Amazon. After Amazon acquired Souq, it continued to use Souq's own brand and retained its core team.

In logistics, Souq has its own logistics company Q Express. Almost all of the items on Souq are delivered by Q Express for the last mile. In addition to Q Express, Souq also acquired the Middle East logistics crowdsourcing platform Wing.ae in 2017. Through Wing.ae, you can integrate other logistics companies in the Middle East and improve the efficiency of delivery.

In terms of payment, Souq has the most well-known PayFort payment gateway in the Middle East. In February 2018, PayFort announced that it has obtained a license from the Saudi Arabian General Investment Authority (Sagia) to operate a wholly-owned payment solution company in the country. PayFort is widely used, and currently the mainstream service platforms in the Middle East such as BEIN Sports, Etihad Airways, Ticketmaster, Air Arabia, Talabat.com are using Payfort's payment services.

In the after-sales service, Souq acquired the after-sales service and life service platform Helpbits who aiming to provide a after-sales service platform for e-commerce consumers, to solve the problem that consumers can't guarantee after-sales service by purchasing electronic products online.

2, Jollychic:A Company come from Zhejiang,China

I still remember that at the end of 2017, Luo Zhenyu, the founder of 'Logical Thinking', held a multi-year lecture in Shanghai - 'Friends of Time'. In his speech, he mentioned the Jollychic .

Luo Zhenyu said: 'In 2017, we found that more and more companies rely on their own rather than market size to conquer the world. JollyChic: A Zhejiang company,who sold thousands of goods to the Middle East ,for what producted by small and medium-sized manufacturing companies along the Yangtze River Delta and Pearl River Delta,and JollyChic became the most famous e-commerce company in the region.'

Founded in late 2012, Zhejiang ZhiYu has its own vertical B2C fashion shopping site- Jollychic, which relies on China's strong supply chain resources to sell affordable goods to Saudi second- and third-tier city shoppers.It focus on clothing, 3C, home, shoe bags, maternal and child categories, etc.. In 2016, it has become the most well-known mobile phone e-commerce provider in the Middle East who is considered to be a dark horse in the Middle East.

In terms of logistics, Jollychic began to open overseas warehouses in the Middle East market in 2016.Jollychic has now built the largest single overseas warehouse in the Middle East. The completion of the local warehouse has shortened the average delivery time of 10-15 days to a minimum of 2 days, achieving the industry's leading level.

3, Noon: the rising star of the Middle East e-commerce

Noon was Invested by the Muhammad Albar and Saudi Arabian Sovereign Fund for $1 billion. It has launched in the UAE at the end of September 2017 and in Saudi Arabia in December.

Noon is a representative of the local e-commerce platform in the Middle East and has a local team. The listing product can be translated into Arabic by its own translator, which is free for Chinese sellers. According to Tarik Fadhil, Commercial Director of Noon's platform,Noon’s translators are natives and have a natural advantage in language.

In terms of logistics, the Noon platform has two logistics modes for Chinese sellers: FBN mode (Fulfilled by noon) and SB2B mode (Seller Back to Back).

SB2B mode: The sellers must sent goods to Noon’s Shenzhen warehouse, and then the goods are sent to the Noon overseas warehouse by Shenzhen warehouse;Finally,logistics team will dilivery the goods to the buyer. The entire process takes 6-10 days. The SB2B mode has no stock risk, but the delivery cycle is long.

FBN (Overseas Warehouse) mode: TThe sellers must sent goods to Noon’s Shenzhen warehouse, and then the goods are sent to the Noon overseas warehouse by Shenzhen warehouse.when buyers place an order, Noon overseas warehouses will ship directly. The overseas warehouse model can achieve the same day.Noon ‘s staff is responsible for the last one-meter distribution and custom packaging services. The cycle of overseas warehouse is greatly shortened, but there is a certain risk of stocking.